utah state food tax

File electronically using Taxpayer Access Point at. Cities and counties in Utah are allowed to levy their own local sales taxes on grocery food and my bill would not change that.

These Are Some Of The Most Popular Foods In Utah

Sales of grocery food unprepared food and food ingredients are subject to a lower 3 percent rate throughout Utah.

. Tax rates are also available online at Utah Sales Use Tax Rates or you can. Grocery food is food sold for ingestion or chewing by humans and consumed for taste or nutrition. After a few seconds you will be provided with a full breakdown of the.

Low-income families spend 36 of their income on food compared to 8 for high-income families. The state currently earns close to 149 million from. Its a proposal that has not found traction within the republican-controlled utah legislature and its leadership which this year prefers an across-the-board 160 million income.

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. Rohner led a referendum effort to stop the 2019 Utah Legislature tax reform package which would have created a 31 increase on the state sales tax on groceries a. The tax on grocery food is 3 percent.

However in a bundled transaction which. It does not contain all tax laws or rules. However in a bundled transaction which.

She also learned this statistic from the US. To use our Utah Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Judy Weeks Rohner and activists have gathered.

For security reasons TAP and other e-services are not available in most countries outside the United States. With that much money the activists say its time to eliminate the 175 state sales tax on groceries as much as 3 when local sales tax options are factored in. Counties and cities can charge an additional local sales tax of up to 24 for a maximum.

There are currently two stalled bills in the 2022 General Session of the Utah Legislature with the aim of ending the 175 state sales tax on food. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Both food and food ingredients will be taxed at a reduced rate of 175.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Upping a portion of the food tax is a new proposal lawmakers talked about for hours on Monday as part of the Tax Restructuring and Equalization Task Force. Please contact us at 801-297-2200 or.

Utah ABC4 Utah legislators are considering putting an end to state food taxes once and for all. Restaurants that sell grocery food in addition to prepared food may collect. SALT LAKE CITY ABC4 News The Utah State Legislature Tax Restructuring and Equalization Tax Force is expected to make a decision Monday evening on whether a proposal.

The first is sponsored by Rep. Both food and food ingredients will be taxed at a reduced rate of 175. In the state of Utah the foods are subject to local taxes.

In the state of Utah the foods are subject to local taxes. On Tuesday Utah State Rep. Grocery food does not include alcoholic.

Voices For Utah Children Utah Tax Reform Proposals Who Wins And Who Loses

Utah Sales Tax Rates By City County 2022

![]()

The Best Food In Utah Best Food In America By State Food Network Food Network

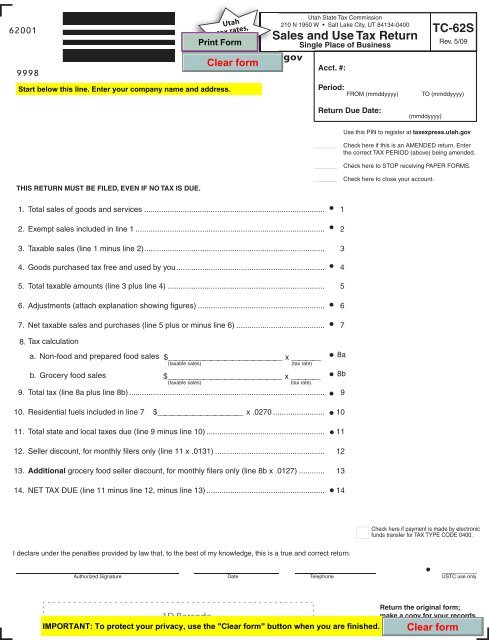

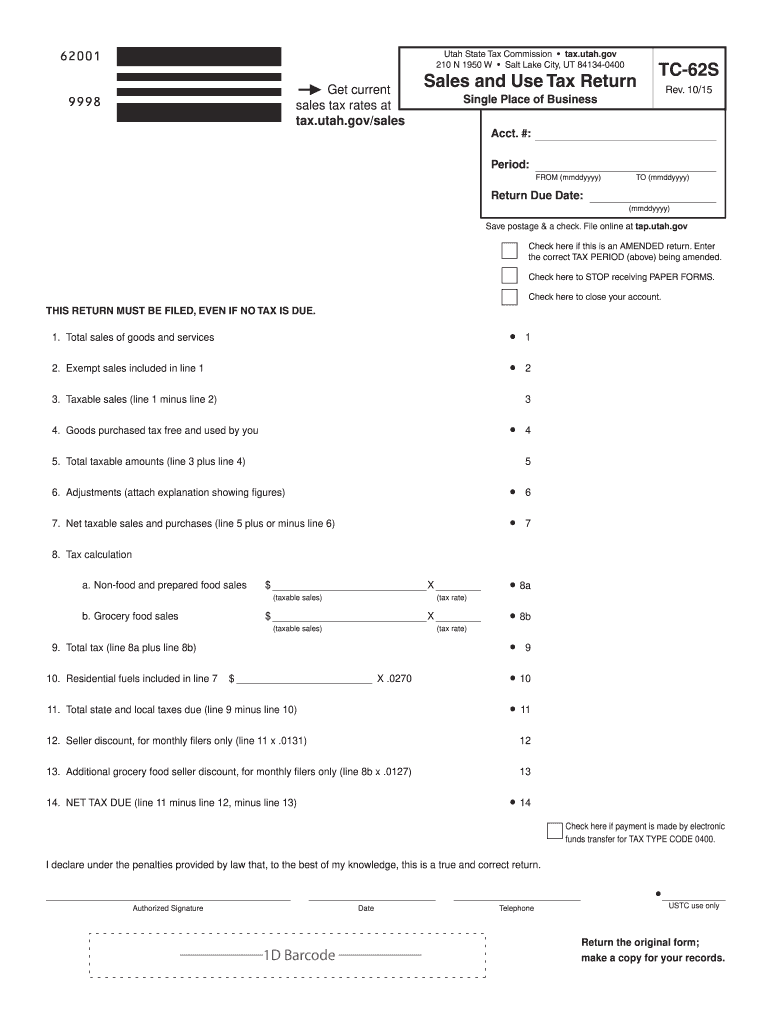

Tc 62s Form Utah Fill Out Sign Online Dochub

Call To Action To End Utah S Food Sales Tax

Sales Tax Laws By State Ultimate Guide For Business Owners

Census Bureau Releases State Tax Collection Data For 2010

Bill Eliminating Sales Tax On Food To Be Reintroduced In Utah Legislature

Tax Plan Latest Income Tax Cuts Food And Gas Tax Hikes Kjzz

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Opponents Of Proposed Food Sales Tax Increase Say Low Income Families Will Suffer

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Sales Tax By State To Go Restaurant Orders Taxjar

Utah Income Tax Calculator Smartasset

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv